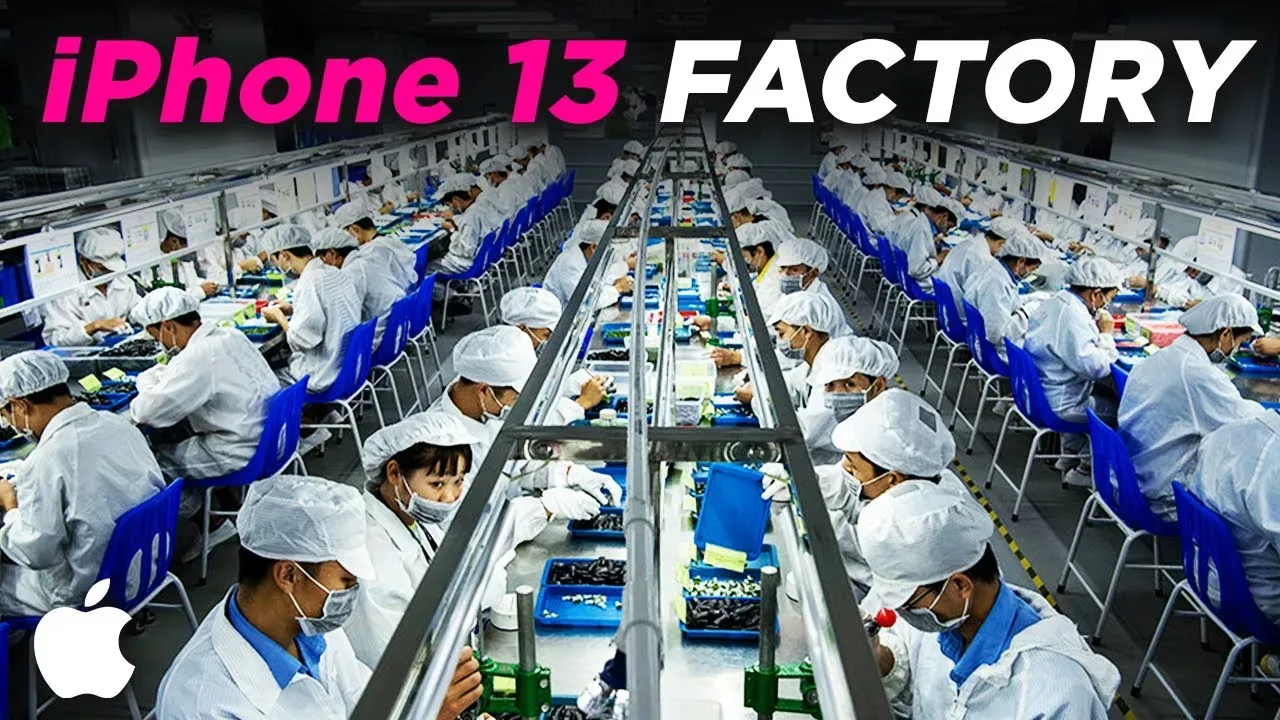

Apple manufacturing iPhones in Indonesia marks a pivotal moment in the tech giant’s relationship with the Southeast Asian nation. Following Indonesia’s controversial ban on the iPhone 16, which stemmed from Apple’s failure to meet investment commitments, the company is now exploring options to produce its flagship devices locally. This shift not only signifies a potential easing of tensions but also aligns with Indonesia’s push for increased local content quotas in manufacturing. With Apple suppliers in discussions about local production, there are implications for the broader market and future iPhone sales in the region. As Apple navigates this complex landscape, the stakes are high for both the company and the Indonesian government, which is eager to bolster its manufacturing sector through significant investments like those promised by Apple.

The prospect of Apple producing its smartphones in Indonesia is generating considerable interest and discussion. By considering local assembly of devices like the iPhone, Apple is potentially opening the door to a new era of production that adheres to Indonesia’s local content regulations. This development comes on the heels of increased scrutiny regarding foreign investment in technology, particularly following the iPhone 16 ban. The Indonesian government’s insistence on a local content quota underscores the importance of domestic manufacturing as a catalyst for economic growth. As the tech industry evolves, partnerships between global brands and local manufacturers could redefine the landscape of smartphone production in the region.

Apple’s Manufacturing Plans in Indonesia

Apple is currently exploring the possibility of manufacturing iPhones in Indonesia, a strategic move that could significantly boost the local economy. Following a sales ban on the iPhone 16, which stemmed from Apple’s failure to meet its investment commitments, the company is now engaged in discussions with its suppliers to localize production. This initiative is not only about complying with government regulations but also about establishing a more resilient supply chain that can bolster Apple’s presence in Southeast Asia.

The potential for Apple manufacturing iPhones in Indonesia aligns with the government’s push for local content quotas, which require companies to source a significant percentage of components locally. By investing in local manufacturing, Apple can enhance its operational efficiency while also contributing to Indonesia’s economic growth. This move could pave the way for new job opportunities in the region, ultimately benefiting both Apple and the Indonesian workforce.

Impact of the iPhone 16 Ban on Apple’s Strategy

The ban on the iPhone 16 in Indonesia marked a critical juncture for Apple, prompting the company to reassess its investment strategies in the region. Initially, Apple had pledged a $110 million investment, which fell short at $95 million, leading to significant repercussions. The ban serves as a reminder of the importance of adhering to local regulations and fulfilling commitments to avoid disruption in one of the largest smartphone markets in Southeast Asia.

In response to the sales ban, Apple has ramped up its investment proposals, culminating in a substantial $1 billion offer aimed at establishing a manufacturing presence in Indonesia. While this investment is a step in the right direction, it remains to be seen whether it will suffice to lift the ban. Apple’s failure to meet local content quotas has challenged its supply chain strategy, highlighting the need for a more integrated approach to manufacturing that aligns with Indonesia’s economic goals.

The Role of Local Content Quotas in Apple’s Operations

Local content quotas are a significant factor influencing multinational companies like Apple in Indonesia. These regulations mandate that a certain percentage of components must be sourced from local suppliers, which can pose challenges for companies accustomed to global supply chains. For Apple, meeting the local content quota of 35% to 40% is crucial to not only comply with Indonesian law but also to enhance its competitive edge in the region.

By establishing a local manufacturing base, Apple can not only adhere to these quotas but also foster relationships with Indonesian suppliers, thereby strengthening its overall supply chain. This strategic move could lead to reduced production costs and shorter lead times, making Apple products more accessible to Indonesian consumers. Ultimately, embracing local content requirements could transform Apple’s operational framework in Indonesia, benefiting both the company and the local economy.

Investment Trends in Apple’s Indonesian Market

Apple’s investment trends in Indonesia reflect a growing commitment to the Southeast Asian market, particularly in light of recent government regulations. Following the sales ban on the iPhone 16, Apple has progressively increased its investment proposals, indicating its recognition of the potential within Indonesia. The company’s willingness to invest in local manufacturing is a testament to its strategy of adapting to regional market demands and regulations.

As Apple considers its manufacturing options, the company’s investments could catalyze further development in Indonesia’s tech sector. This influx of capital not only signifies Apple’s intent to establish a robust presence in the market but also highlights the importance of strategic partnerships with local suppliers. With ongoing discussions about local manufacturing, Apple is poised to play a pivotal role in shaping the future of Indonesia’s technology landscape.

Challenges Faced by Apple in Complying with Local Regulations

Apple’s journey toward compliance with local regulations in Indonesia has been fraught with challenges, particularly regarding the local content quota. The company’s initial failure to meet its investment commitments led to significant repercussions, including the sales ban on the iPhone 16. Navigating the complex regulatory environment in Indonesia requires Apple to adapt its business strategies and enhance its collaboration with local suppliers to ensure compliance and success.

To overcome these challenges, Apple must not only focus on increasing its investment but also on building a sustainable supply chain within Indonesia. Establishing partnerships with local manufacturers and suppliers will be essential to meet the local content requirements and ensure a smooth manufacturing process. This commitment to compliance and local collaboration is vital for Apple to regain market trust and capitalize on the vast potential of the Indonesian smartphone market.

Future Prospects for Apple in Indonesia

The future prospects for Apple in Indonesia appear promising, particularly if the company successfully navigates the current challenges related to local manufacturing and compliance with government regulations. With ongoing negotiations about establishing manufacturing facilities, Apple has the opportunity to enhance its market presence and cater to the growing demand for smartphones in the region. The lifting of the iPhone 16 ban could act as a catalyst for renewed sales and brand loyalty among Indonesian consumers.

As Apple invests in local manufacturing, it may also explore innovative approaches to product offerings tailored to the Indonesian market. This could include introducing more affordable models or localized features that resonate with Indonesian consumers. By aligning its strategies with local preferences and regulations, Apple stands to not only recover from the setbacks of the past but also solidify its position as a leading player in Indonesia’s dynamic tech landscape.

Apple’s Response to Government Regulations

Apple’s response to government regulations in Indonesia has been a critical aspect of its operational strategy. The recent sales ban on the iPhone 16 has prompted Apple to reevaluate its approach to investment and compliance, emphasizing the need for a more collaborative relationship with the Indonesian government. By actively engaging in discussions about local manufacturing, Apple demonstrates its commitment to adhering to local laws and meeting the expectations of Indonesian authorities.

The company’s strategic pivot towards local production reflects a broader trend among multinational corporations to adapt to regional regulatory environments. Apple’s willingness to negotiate and invest in Indonesia showcases its recognition of the importance of local partnerships in achieving long-term success. By aligning its operations with government regulations, Apple can foster goodwill and potentially mitigate future challenges in its pursuit of growth in the Indonesian market.

The Competitive Landscape of Smartphone Manufacturing in Indonesia

The competitive landscape of smartphone manufacturing in Indonesia is evolving, with several key players vying for market share. Apple’s consideration of local manufacturing places it in direct competition not only with global rivals like Huawei, which is also planning to establish production in the country, but also with established local brands. This competition underscores the necessity for Apple to differentiate itself through innovative products and localized strategies that resonate with Indonesian consumers.

To maintain its competitive edge, Apple must leverage its brand reputation while adapting to the unique preferences and needs of the Indonesian market. This may involve tailoring product offerings or pricing strategies to appeal to local consumers. As the smartphone market in Indonesia continues to grow, Apple’s ability to navigate this competitive landscape will determine its success and relevance in a rapidly changing industry.

Apple’s Long-Term Vision for Indonesia

Apple’s long-term vision for Indonesia is centered on establishing a sustainable and profitable presence in one of Southeast Asia’s largest markets. The company’s recent initiatives to invest in local manufacturing and comply with government regulations reflect a strategic commitment to the region. By fostering local partnerships and adapting its business model, Apple aims to create a resilient supply chain that not only meets local demands but also aligns with its global operational goals.

As Apple looks to the future, the potential for growth in Indonesia remains significant. With a large and youthful population eager for technology, the Indonesian market presents ample opportunities for innovation and expansion. By investing in local manufacturing and addressing regulatory requirements, Apple can ensure its long-term success in Indonesia while contributing to the country’s economic development.

Frequently Asked Questions

What are the implications of Apple manufacturing iPhones in Indonesia?

Apple manufacturing iPhones in Indonesia could greatly benefit the local economy by creating jobs and fostering technological development. This move would also help Apple meet Indonesia’s local content quota requirement, which mandates that 35% to 40% of components be sourced locally. Additionally, it could enhance Apple’s market presence in a region where it faces competition from other manufacturers.

How will the local content quota affect Apple’s plans for manufacturing iPhones in Indonesia?

The local content quota is crucial for Apple as it outlines the requirement to source 35% to 40% of components locally for iPhones. This means that Apple must establish a robust supply chain in Indonesia, which may involve working closely with local suppliers to meet these requirements. Failure to comply could hinder Apple’s ability to manufacture iPhones in the country and may lead to further regulatory challenges.

What led to the ban on the iPhone 16 sales in Indonesia?

The ban on iPhone 16 sales in Indonesia was primarily due to Apple’s failure to meet its investment commitment of approximately $110 million. Instead, Apple invested only $95 million, prompting the Indonesian government to enforce a sales ban until Apple demonstrates compliance with local manufacturing and investment expectations.

How does Apple’s investment in Indonesia influence its manufacturing strategy?

Apple’s investment strategy in Indonesia is critical as it directly impacts its ability to manufacture iPhones locally. The company is currently negotiating with suppliers to establish manufacturing capabilities that align with the local content quota. A successful investment would not only lift the iPhone 16 ban but also enhance Apple’s operational efficiency in one of Southeast Asia’s largest markets.

What challenges does Apple face in setting up iPhone manufacturing in Indonesia?

Apple faces several challenges in establishing iPhone manufacturing in Indonesia, including meeting local content quotas, building a reliable supply chain, and navigating regulatory requirements. Additionally, Apple’s previous underinvestment and the ongoing iPhone 16 ban complicate the situation, requiring careful negotiation with the Indonesian government and local suppliers to ensure compliance and successful operations.

Can Apple avoid future sales bans for iPhones in Indonesia?

To avoid future sales bans for iPhones in Indonesia, Apple must adhere to local investment commitments and comply with the local content quota requirements. By successfully establishing manufacturing operations and sourcing components locally, Apple can significantly reduce the risk of regulatory actions that could impede its sales in the Indonesian market.

What recent developments indicate Apple’s commitment to manufacturing iPhones in Indonesia?

Recent reports suggest that Apple is engaged in discussions with its suppliers regarding the potential for local iPhone manufacturing in Indonesia. This comes after the Indonesian government imposed a sales ban on the iPhone 16 due to Apple’s insufficient investment. Apple’s willingness to negotiate and consider local manufacturing indicates a strong commitment to meeting regulatory requirements and enhancing its market presence.

What is the significance of the Indonesian government’s local content quota for Apple?

The Indonesian government’s local content quota is significant for Apple as it sets a clear requirement for sourcing a substantial percentage of components locally for iPhones. This quota not only supports local economic growth but also serves as a regulatory benchmark that Apple must meet to ensure compliance and maintain its business operations in Indonesia, particularly following the iPhone 16 sales ban.

| Key Points | Details |

|---|---|

| Sales Ban on iPhone 16 | Indonesia banned sales of the iPhone 16 in October 2024 due to Apple’s failure to fulfill investment commitments. |

| Investment Commitments | Apple had committed to a $110 million investment but only invested $95 million. |

| Local Manufacturing Negotiations | Reports indicate Apple is negotiating with suppliers about possible local manufacturing in Indonesia. |

| Local Content Quota | Indonesia requires 35% to 40% of smartphone components to be sourced locally. |

| Response to Government | After the ban, Apple made several investment proposals, including a $1 billion offer accepted by Indonesia. |

| Future of iPhone 16 Ban | Indonesian officials have hinted at a resolution to the ban, but no concrete steps have been announced. |

| Market Potential | Before the ban, Apple projected to sell 2.9 million iPhones in Indonesia, reaching only about 2% of potential buyers. |

Summary

Apple manufacturing iPhones in Indonesia marks a significant shift in the tech giant’s strategy to comply with local regulations and enhance its market presence in the country. Following a sales ban on the iPhone 16 due to unmet investment commitments, Apple is now exploring local manufacturing options while facing a local content quota requirement. This development highlights the growing importance of local production in global supply chains and the need for multinational companies to adapt to regional policies. As negotiations continue, the outcome could reshape the competitive landscape for smartphone manufacturers in Indonesia.