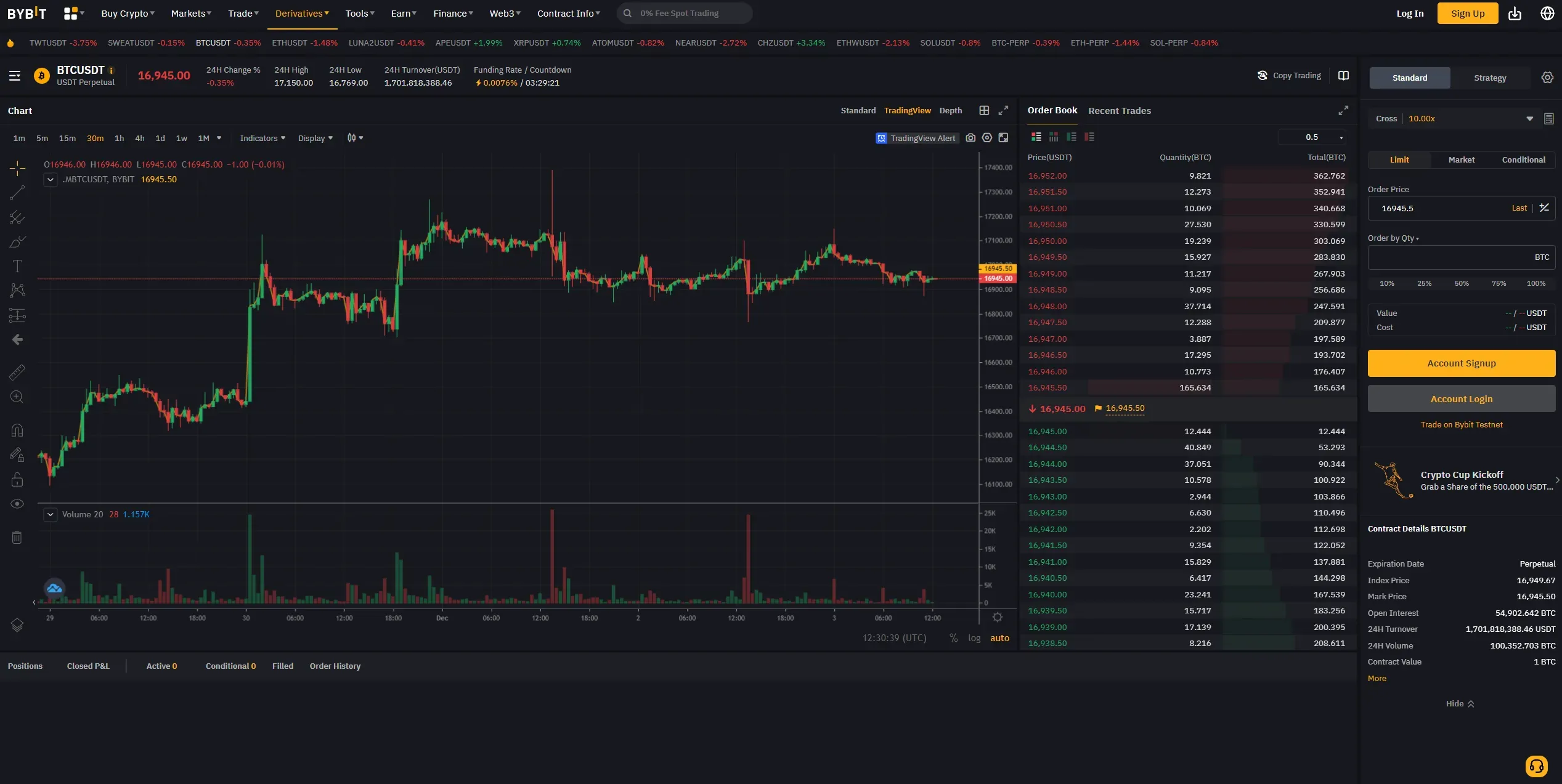

The Bybit cryptocurrency heist has sent shockwaves through the crypto community, marking what could be the largest cryptocurrency theft in history. In a bold and sophisticated attack, hackers managed to steal approximately 401,346 Ethereum from Bybit, a leading cryptocurrency exchange. This staggering theft, valued at around $1.4 billion at the time, highlights the urgent need for enhanced crypto security measures across the industry. Bybit CEO Ben Zhou reassured users that the exchange is solvent and capable of covering the loss, but the incident raises serious concerns about the vulnerabilities in the crypto ecosystem. As news of the Bybit hack continues to unfold, it serves as a stark reminder of the risks associated with digital assets and the ongoing battle against cybercrime in the cryptocurrency space.

In a shocking turn of events, the recent cyber theft involving the Bybit exchange has captivated the attention of both investors and security experts alike. This incident, often referred to as one of the largest breaches in the realm of digital currencies, underscores the critical importance of safeguarding crypto assets. With a significant amount of Ethereum stolen, the implications of this heist extend beyond financial loss; they also call into question the integrity of security protocols employed by exchanges. As the Bybit hack news circulates, industry stakeholders are urged to rethink their strategies for protecting against potential threats. The fallout from this unprecedented attack serves as a crucial wake-up call for the entire cryptocurrency landscape.

Understanding the Bybit Cryptocurrency Heist

The Bybit cryptocurrency heist has shaken the crypto community to its core, marking what is potentially the largest theft in the history of digital assets. With approximately 401,346 Ethereum stolen, valued at around $1.4 billion, this incident highlights the vulnerabilities that exist within even the most secure exchanges. Bybit’s announcement of being targeted by a ‘sophisticated’ attack raises questions about the security measures in place to protect users’ assets and the overall integrity of cryptocurrency storage methods.

In the aftermath of the Bybit hack news, many are left wondering how such a large-scale theft could occur. The fact that the Ethereum was taken from a cold wallet, which is typically considered one of the safest storage options, suggests that the attackers employed advanced techniques to breach Bybit’s security protocols. Bybit CEO Ben Zhou’s assurances that the exchange is solvent and can cover the loss are crucial for maintaining user confidence, but they also highlight the need for improved crypto security across the industry.

The Implications of the Largest Cryptocurrency Theft

This unprecedented incident not only raises alarms about the immediate financial implications for Bybit but also serves as a critical wake-up call for the entire cryptocurrency ecosystem. The massive scale of the theft places Bybit in a precarious position, as users may reconsider the safety of their investments in light of this breach. If cryptocurrency exchanges like Bybit cannot guarantee the safety of funds, it may deter new investors and users from entering the market.

Moreover, the Bybit heist brings to the forefront the ongoing discussions about regulatory measures in the cryptocurrency space. As this theft demonstrates, the lack of regulation can result in significant losses for investors, making it essential for governments to consider implementing frameworks that enhance crypto security. The involvement of high-profile figures, such as President Trump and Elon Musk, in the cryptocurrency sphere may also influence public perception and regulatory approaches in response to incidents like the Bybit hack.

Ben Zhou’s Response to the Bybit Hack

In a livestream following the heist, Ben Zhou sought to reassure Bybit users by emphasizing the exchange’s financial stability and commitment to protecting clients’ assets. His statement regarding Bybit’s solvency is crucial in preserving user trust, especially after an event that could severely undermine confidence in the platform. Zhou’s proactive communication is a vital strategy in the face of such adversity, as transparency can help bridge the gap between the exchange and its users during turbulent times.

Furthermore, Zhou’s remarks on the situation highlight the importance of having a robust crisis management plan in place for cryptocurrency exchanges. The ability to quickly address concerns and provide clear information about the security of user assets is essential in maintaining trust. As the Bybit hack continues to make headlines, other exchanges are likely watching closely to see how Zhou’s actions impact user sentiment and whether his statements can effectively mitigate the fallout from this significant theft.

The Role of Cryptocurrency Regulation Post-Heist

As the cryptocurrency landscape continues to evolve, the Bybit heist underscores the urgent need for regulatory frameworks that can better protect investors and secure exchanges. The incident has sparked discussions among lawmakers and regulators about the implications of such thefts on the broader financial system. By establishing clear regulations and guidelines, the industry could work towards minimizing risks associated with digital asset management and theft.

Regulation could also facilitate the development of standardized security measures across exchanges, making it more difficult for hackers to exploit vulnerabilities. In light of the Bybit hack and other notable breaches, stakeholders in the cryptocurrency ecosystem must advocate for a balance between innovation and security. This approach will help ensure that the growth of the industry does not come at the expense of investor safety and trust.

Lessons Learned from Previous Cryptocurrency Breaches

The Bybit cryptocurrency heist is not an isolated incident but rather part of a troubling trend in the digital asset space. Previous breaches, such as the Poly Network hack in 2021 and the Ronin platform compromise in 2022, have demonstrated that vulnerabilities exist within the systems designed to protect cryptocurrencies. Each incident provides valuable lessons that can help improve security protocols and response strategies for exchanges and users alike.

By studying these past events, the industry can identify common weaknesses and implement stronger safeguards against potential breaches. The collective knowledge gained from these experiences can guide exchanges like Bybit in enhancing their security measures, educating users about safe practices, and fostering a culture of transparency and trust within the cryptocurrency community.

The Future of Cryptocurrency Amidst Growing Security Concerns

As the cryptocurrency market continues to grow, so too do concerns about security and theft. The Bybit heist serves as a stark reminder that while the potential for profit in the crypto space is significant, so are the risks. Investors must remain vigilant and informed about the security practices of the platforms they choose to use, as well as the broader implications of breaches on their investments.

Moving forward, the cryptocurrency community must prioritize the development of robust security measures and advocate for regulations that protect users from theft. By fostering a safer environment for trading and investing, the industry can work towards building confidence among users, which is essential for long-term growth and stability in the cryptocurrency market.

The Impact of High-Profile Figures on Cryptocurrency Security

The involvement of influential figures like President Trump and Elon Musk in the cryptocurrency space has significant implications for public perception and security. Their support can lead to increased interest and investment in cryptocurrencies, but it also brings heightened scrutiny and expectations regarding the safety of digital assets. The Bybit heist has placed additional pressure on these figures to advocate for stronger security measures within the industry.

As prominent advocates for cryptocurrencies, Trump and Musk can play a crucial role in promoting awareness of security issues and supporting initiatives that enhance protection for investors. Their platforms can be leveraged to educate the public about the risks associated with crypto investments and the importance of choosing secure exchanges. This dual approach could help mitigate the impact of incidents like the Bybit hack and bolster overall confidence in the cryptocurrency market.

Comparing the Bybit Heist to Other Major Crypto Thefts

When assessing the Bybit cryptocurrency heist, it is essential to compare it to other significant thefts in the crypto space. The Poly Network hack and the Ronin breach are two notable examples that highlight the ongoing risks associated with digital assets. Each incident reveals different tactics employed by hackers and the resulting losses, underscoring the need for continuous improvement in security measures across the industry.

By examining these past events, stakeholders can better understand the evolving nature of cybercrime in the cryptocurrency sector. The Bybit heist, with its staggering loss of $1.4 billion, serves as a critical point of reference for exchanges to reevaluate their security strategies. Learning from previous breaches can help prevent similar occurrences in the future and create a safer trading environment for all users.

The Importance of User Education in Cryptocurrency Security

In light of the Bybit heist, user education emerges as a vital component in enhancing cryptocurrency security. Investors must be aware of the risks associated with trading and storing digital assets, as well as the security practices they should adopt to protect themselves. By providing comprehensive resources and guidance, exchanges can empower users to make informed decisions about their investments and reduce the likelihood of falling victim to theft.

Moreover, fostering a culture of vigilance among users can play a crucial role in enhancing overall security in the cryptocurrency ecosystem. Bybit and other exchanges should prioritize educational initiatives that focus on best practices for asset protection, recognizing that informed users can help create a more secure environment for all. This proactive approach can mitigate the impact of breaches and bolster confidence in the cryptocurrency market.

Frequently Asked Questions

What happened in the Bybit cryptocurrency heist?

The Bybit cryptocurrency heist involved hackers executing what could be the largest theft of cryptocurrency in history, stealing approximately 401,346 Ethereum, valued at around $1.4 billion, from the exchange’s cold wallet.

How did the Bybit hack occur?

The Bybit hack was described as a sophisticated attack, where hackers transferred stolen Ethereum from Bybit’s cold wallet to their warm wallet, exploiting vulnerabilities in crypto security.

What did Bybit CEO Ben Zhou say about the theft?

In his statement, Bybit CEO Ben Zhou confirmed the theft of Ethereum and assured users that the exchange is solvent and can cover the loss of assets.

Is Bybit safe after the cryptocurrency heist?

Following the Bybit cryptocurrency heist, CEO Ben Zhou stated that all clients’ assets are secured and that the exchange remains solvent, indicating ongoing efforts to enhance crypto security.

How does the Bybit heist compare to other cryptocurrency thefts?

The Bybit heist is notable for potentially being the largest cryptocurrency theft in history, surpassing previous breaches like the Poly Network hack ($600 million) and the Ronin blockchain theft ($615 million).

What should users know about cryptocurrency security after the Bybit hack news?

The Bybit hack news highlights the importance of robust crypto security measures. Users should remain vigilant and consider using hardware wallets for better protection against such large-scale heists.

What does the theft of Ethereum from Bybit mean for the crypto market?

The theft of Ethereum from Bybit emphasizes the risks in the crypto market and may affect investor confidence, as it reveals vulnerabilities in even established exchanges, sparking discussions around improved security practices.

| Key Point | Details |

|---|---|

| Type of Incident | Heist of cryptocurrency from Bybit exchange |

| Amount Stolen | Approximately 401,346 Ethereum, equivalent to $1.4 billion |

| Nature of Attack | Described as ‘sophisticated’ by Bybit |

| Wallets Involved | Funds were stolen from a cold wallet and moved to a warm wallet |

| Company Response | Bybit CEO stated the exchange is solvent and can cover the loss |

| Notable Context | Heist occurs amid growing support for cryptocurrency in government |

| Previous Breaches | Previous major breaches include Poly Network ($600 million) and Ronin ($615 million) |

Summary

The Bybit cryptocurrency heist marks a significant event in the world of digital finance, as it stands to be one of the largest thefts in cryptocurrency history. In this incident, hackers exploited vulnerabilities within the Bybit exchange, resulting in the loss of over $1.4 billion worth of Ethereum. This brazen act not only highlights the ongoing risks associated with cryptocurrency trading but also underscores the need for enhanced security measures within digital asset platforms. As the cryptocurrency landscape continues to evolve, incidents like the Bybit heist serve as a stark reminder of the challenges that users and exchanges face in safeguarding their assets.