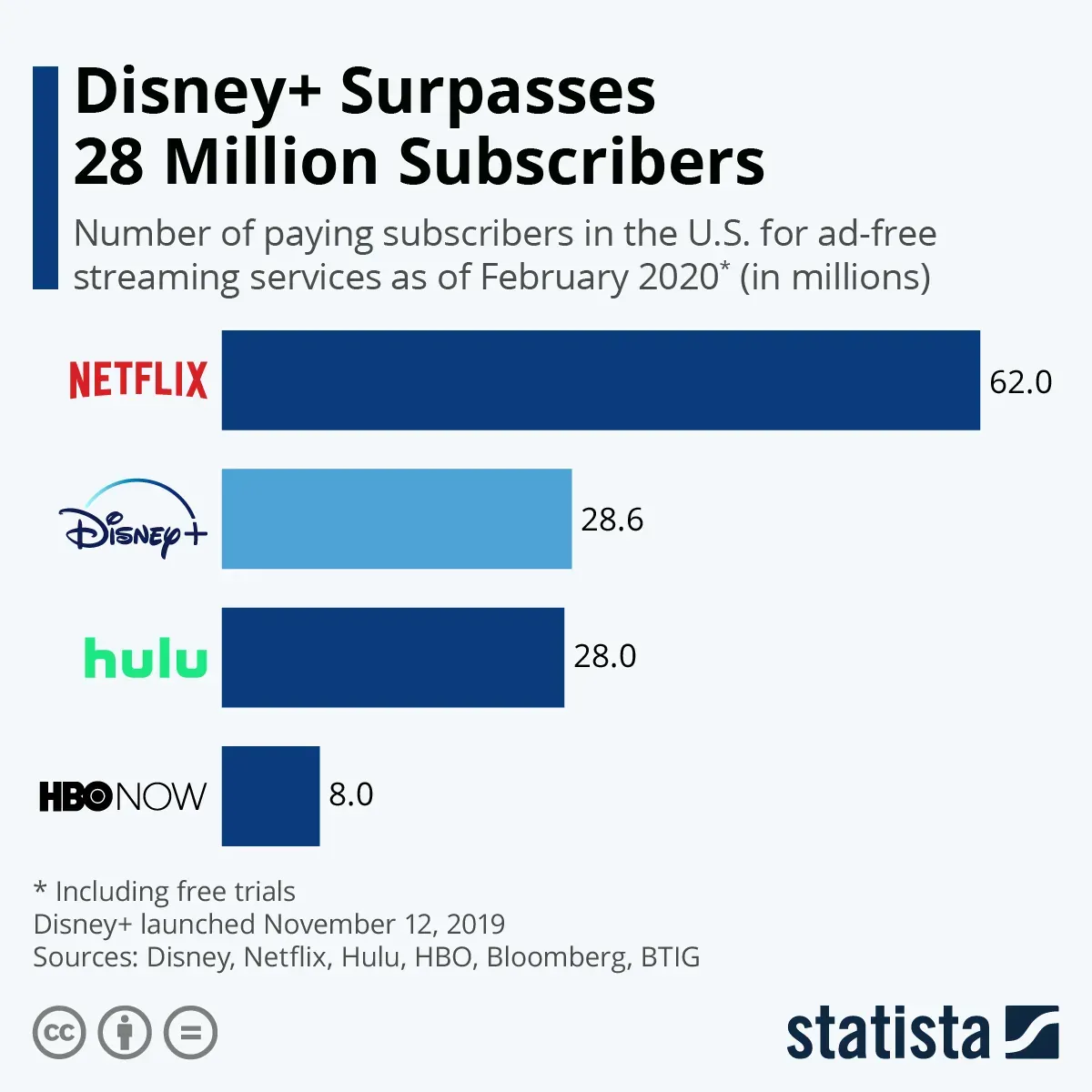

Disney+ streaming trends have taken a significant turn in 2024, as the platform navigates a challenging landscape marked by subscriber loss and price hikes. The service experienced a staggering 700,000 cancellations in just three months, highlighting the impact of recent changes including a $2 price increase and a crackdown on password sharing. Despite this subscriber exodus, Disney+ has reported three consecutive quarters of profitability, showcasing a shift in focus from growth to financial sustainability. This trend raises questions about the future of streaming service trends, particularly as Disney continues to balance profitability with customer retention. With the ongoing debate around Disney+ price increases and reduced content output, the streaming giant’s strategy may redefine the industry landscape in the coming years.

The current dynamics surrounding Disney+ reflect broader patterns in the streaming industry, as platforms adapt to changing consumer behavior and market pressures. With a significant subscriber drop, many are examining how recent adjustments like price hikes and stringent password sharing policies influence user engagement. As businesses pivot from aggressive growth to prioritizing profitability, the implications for streaming services become increasingly evident. Observers are keen to see how Disney’s tactics, including a focus on fewer but higher-quality productions, will resonate with audiences and affect overall subscriber loyalty. Ultimately, the developments at Disney+ could serve as a barometer for the evolving landscape of digital entertainment.

Disney+ Streaming Trends and Subscriber Dynamics

Disney+ has recently experienced a notable shift in its subscriber dynamics, particularly in light of the rapid changes in the streaming industry. The service lost approximately 700,000 subscribers in the last quarter of 2024, driven by a combination of price increases and a crackdown on password sharing. This subscriber loss, while significant, reflects broader trends across the streaming landscape, where consumers are becoming increasingly selective about their subscriptions. As competition heats up, streaming services are forced to reevaluate their strategies, leading to a focus on profitability rather than sheer growth.

Despite the losses, Disney+ maintains a substantial global subscriber base of 124.6 million users. This indicates that while there is some pushback against price hikes, the overall appeal of Disney’s extensive content library, including beloved franchises, continues to attract a sizable audience. The current streaming service trends reveal a market where consumers are willing to tolerate certain inconveniences, such as ads and higher prices, for the sake of quality content. As streaming services adapt to these dynamics, they may need to innovate further to retain subscribers in such an evolving landscape.

The Impact of Disney+ Price Increases on Subscriber Behavior

In 2024, Disney+ implemented a price increase of $2 for both ad-supported and ad-free subscriptions, marking a significant shift in its pricing strategy. This move aligns with industry trends where many streaming platforms have raised prices to enhance profitability. However, the increase has not come without repercussions. The loss of 700,000 subscribers highlights consumer sensitivity to pricing, especially in a market saturated with options. As users weigh the value of their subscriptions, Disney+ must navigate the fine line between generating revenue and maintaining a loyal subscriber base.

The price hike is part of a larger trend in the streaming service industry, where companies are increasingly prioritizing profitability over subscriber growth. While Disney’s CEO Bob Iger celebrates consecutive quarters of profitability, the reality is that such strategies can alienate users. Many subscribers are evaluating the cost-effectiveness of their streaming services, leading to cancellations when they perceive that the value does not match the expense. This trend raises critical questions about the future of Disney+ and its ability to attract and retain subscribers in a competitive streaming environment.

Profitability vs. Content Quality on Disney+

Disney+ has recently shifted its focus from growth to profitability, a decision that has resulted in a reduction of original content output. This strategy comes at a time when the service is already facing challenges, such as a crackdown on password sharing and increased prices. While some stakeholders may view fewer releases as an opportunity to enhance quality, the reality is that this reduction can diminish subscriber motivation, especially for fans accustomed to a steady stream of new content from franchises like Star Wars and Marvel. With less original programming to entice viewers, Disney+ must find new ways to keep their audience engaged.

The emphasis on profitability has led to a significant cut in spending on exclusive content that once drove subscriptions. As Disney+ scales back on the quantity of its offerings, the challenge remains to retain existing customers while attracting new ones. The streaming landscape is increasingly competitive, and if viewers feel that Disney+ no longer meets their entertainment needs, they may look to alternative services. This scenario underscores the delicate balance between maintaining profitability and ensuring that content quality and availability remain sufficient to keep subscribers satisfied.

The Role of Password Sharing Policies in Subscriber Retention

The crackdown on password sharing has been a pivotal strategy for Disney+ in 2024, aimed at curbing subscriber losses and enhancing revenue. With nearly three-quarters of a million users opting to cancel their subscriptions, it’s evident that the enforcement of these policies has left many consumers feeling restricted. While password sharing has been a longstanding issue for streaming services, Disney’s approach highlights a significant shift in how companies view shared accounts. As platforms tighten access, the challenge lies in convincing users that the value of a subscription outweighs the convenience of sharing.

The implications of such policies extend beyond immediate subscriber numbers; they also reflect general trends within the streaming sector. As services like Disney+ look to bolster profits, the focus on individual subscriptions can lead to a more significant reliance on loyal customers. However, this strategy may be a double-edged sword, as many consumers are now reconsidering their subscriptions in light of increased costs and fewer sharing options. Ultimately, how Disney+ navigates these changes will be crucial in determining its long-term success in an ever-evolving market.

Evaluating Disney+ Original Content Strategy

Disney+ has faced scrutiny over its original content strategy as it adapts to changing market conditions. The reduction in the output of original shows and films raises questions about the service’s long-term appeal. With the company prioritizing profitability through cost-cutting measures, fans are left wondering whether the remaining offerings will meet their expectations. The shift in strategy indicates a focus on fewer, higher-quality releases, but this also means that subscribers may not find enough content to justify their monthly payments.

As Disney+ navigates this new landscape, the challenge will be to attract viewers back to the platform with compelling original content. The company’s historical focus on franchises like the MCU and Star Wars has been a significant draw for subscribers, and a decline in these productions could lead to a loss of interest among dedicated fans. To counteract this trend, Disney+ must innovate and create unique offerings that resonate with its audience, ensuring that the platform remains a viable choice amid the growing competition from other streaming services.

The Future of Disney+ in a Competitive Streaming Landscape

The future of Disney+ rests on its ability to adapt to the rapidly changing streaming landscape. As the service has experienced subscriber losses due to price increases and password-sharing crackdowns, the question arises: can Disney+ maintain its substantial user base while continuing to raise prices? The competitive nature of the streaming industry means that consumer loyalty can be fleeting, and platforms must consistently deliver value to retain subscribers. Disney+ must find innovative ways to engage its audience and provide compelling reasons to stay.

Looking ahead, Disney+ will likely need to reassess its content strategy and pricing model to remain competitive. As other streaming services also navigate similar challenges, the importance of maintaining a diverse and appealing content library cannot be overstated. By investing in high-quality original programming and understanding consumer preferences, Disney+ can position itself to rebound from its recent losses and thrive in a crowded market. The balance between profitability and subscriber satisfaction will be critical as Disney+ strives to carve out its niche among competing platforms.

Consumer Sentiment Towards Disney+ Pricing Strategies

Consumer sentiment towards Disney+ and its pricing strategies has evolved dramatically in response to recent changes. The $2 price increase, coupled with the enforcement of strict password sharing policies, has sparked frustration among subscribers. Many users feel that the value they receive no longer matches the cost of their subscription, leading to a growing trend of cancellations. This shift in sentiment reflects a broader trend in the streaming industry, where consumers are becoming increasingly discerning about where they allocate their entertainment budgets.

As Disney+ grapples with these challenges, understanding consumer sentiment will be paramount. The company must actively engage with its audience to gauge reactions to its pricing and content strategies. By listening to feedback and making necessary adjustments, Disney+ can work to rebuild trust and loyalty among its subscribers. This proactive approach to consumer relations will be essential in reversing the trend of subscriber loss and ensuring the platform’s continued success in a highly competitive environment.

The Financial Implications of Disney+ Subscriber Losses

While the loss of 700,000 subscribers may seem alarming, Disney+ continues to report strong financial performance, highlighting a complex relationship between subscriber numbers and profitability. The company’s recent focus on profitability over growth reflects a broader trend in the streaming industry, where services are increasingly prioritizing revenue generation. Despite the subscriber loss, Disney’s ability to maintain financial health suggests that the remaining user base is more engaged and willing to pay for the content they value.

The implications for Disney+ are profound. As the service navigates through these changes, it can leverage its profitability to invest in high-quality content that appeals to its core audience. This focus on enhancing the value proposition for subscribers could help to stabilize the platform in the face of increasing competition. By strategically balancing its financial goals with the needs of its consumers, Disney+ can work towards reversing subscriber losses and ensuring long-term sustainability.

Long-Term Strategies for Disney+ Success

For Disney+ to achieve long-term success in the streaming market, it must develop comprehensive strategies that address both subscriber retention and content quality. A focus on delivering exclusive, high-quality programming could entice former subscribers to return while attracting new users. Moreover, understanding the importance of consumer sentiment and feedback will be essential in shaping future content and pricing decisions. As the streaming landscape continues to evolve, Disney+ must remain agile and responsive to market demands.

In addition to content strategy, Disney+ should consider exploring partnerships or bundled offerings that enhance its value proposition. By collaborating with other services or enhancing its existing offerings, Disney+ can create a more attractive subscription model that appeals to a broader audience. Ultimately, the key to long-term success will lie in Disney+’s ability to innovate, adapt, and prioritize subscriber satisfaction while navigating the complexities of an increasingly competitive streaming environment.

Frequently Asked Questions

What are the latest Disney+ streaming trends regarding subscriber loss?

Disney+ has experienced significant subscriber loss, with 700,000 users canceling their subscriptions in late 2024. This trend highlights the impact of rising prices and a crackdown on password sharing, reflecting broader challenges in the streaming industry.

How has the recent Disney+ price increase affected subscriber retention?

The recent price increase of $2 for both ad-supported and ad-free services has contributed to a notable drop in subscribers. Despite this, Disney+ still maintains a global subscriber base of 124.6 million, indicating that while some users have left, the majority remain.

What does Disney+ profitability mean for streaming service trends?

Disney+ profitability, achieved after consecutive price hikes and reduced content output, signifies a shift in streaming service trends from growth-focused strategies to profit maximization. This trend may encourage other platforms to follow suit, potentially leading to increased prices across the streaming industry.

How is password sharing crackdown impacting Disney+ streaming trends?

The crackdown on password sharing initiated by Disney+ has been a key factor in the recent subscriber loss. As users adjust to stricter access policies, the streaming service is observing shifts in viewing habits and subscriber retention, reflecting a broader trend in the industry.

What are the implications of reduced content output for Disney+ subscribers?

The reduction in original content output on Disney+ could lead to decreased motivation for year-round subscriptions. As the platform focuses on fewer, higher-quality shows, subscribers may find less exclusive content behind the paywall, influencing their decision to stay or leave.

Are Disney+ streaming trends reflective of larger industry patterns?

Yes, Disney+’s recent strategies, including price increases and content reduction, mirror larger streaming service trends where profitability is prioritized over subscriber growth. This shift is becoming increasingly common among major streaming platforms, suggesting a new standard in the industry.

How does Disney+’s strategy affect future streaming service trends?

Disney+’s approach of increasing prices while cutting back on content may set a precedent for future streaming service trends. Other platforms might adopt similar strategies, focusing on profitability over subscriber growth, which could reshape the streaming landscape.

| Key Point | Details |

|---|---|

| Subscriber Loss | Disney+ lost 700,000 subscribers in the last quarter of 2024. |

| Price Increases | Disney raised prices for both ad-supported and ad-free services by $2. |

| Password Sharing Crackdown | A crackdown on password sharing started late last year contributing to subscriber loss. |

| Financial Success | Despite subscriber loss, Disney+ reported three consecutive quarters of profitability. |

| Content Strategy Shift | Disney is reducing original content output, particularly for Star Wars and MCU. |

| Consumer Concerns | The strategy raises concerns among consumers, with fewer incentives to maintain subscriptions. |

| Industry Trends | The approach by Disney+ may embolden other streaming services to adopt similar practices. |

Summary

Disney+ streaming trends in 2024 reveal a significant shift in the platform’s strategy, focusing on profitability over subscriber growth. Despite losing 700,000 subscribers, Disney+ has managed to maintain its overall subscriber count at 124.6 million and achieve financial success. The combination of price hikes, a crackdown on password sharing, and a reduction in original content has raised concerns among consumers about the platform’s long-term value. As Disney+ leads the way, other streaming services may follow suit, potentially resulting in a trend of increasing prices and reduced content availability across the industry.