iPhone prices are under scrutiny as recent analyses suggest that tariffs could lead to a significant increase in costs for consumers. According to Bank of America, these tariffs might push iPhone prices up by around 9%, impacting not only Apple’s bottom line but also consumer buying behavior. The implications of this price hike are far-reaching, as the analysis highlights how Apple’s manufacturing costs and sales could be affected by these tariffs. In light of the ongoing discussions about the Apple tariff impact, it’s crucial for potential buyers to consider how these changes could affect their purchasing decisions. As the situation evolves, keeping an eye on iPhone prices will be essential for understanding the broader market dynamics.

The current landscape of smartphone pricing is heavily influenced by various economic factors, particularly concerning Apple’s flagship device, the iPhone. Recent insights into the potential price changes reveal that the ongoing tariff situation could lead to higher costs for consumers, significantly altering market expectations. Analysts, including those from Bank of America, have indicated that these shifts in pricing could stem from increased manufacturing expenses and the pressure of international trade policies. As consumers navigate the complexities of smartphone ownership, understanding the nuances of pricing fluctuations and their causes becomes increasingly important. The conversation surrounding iPhone prices and their relationship to global tariffs is vital for anyone considering a new device.

Impact of Tariffs on iPhone Prices

The recent analysis from Bank of America highlights a significant concern for Apple regarding the potential increase in iPhone prices due to tariffs imposed by the U.S. government. According to their estimates, a 9% price hike could be necessary for Apple to mitigate the financial impact of these tariffs. This is a critical issue, as price increases can directly affect consumer demand and ultimately influence Apple’s sales performance. If Apple decides to pass on the additional costs to consumers, it risks pushing some loyal customers towards competing brands, particularly Android, which may offer more budget-friendly options.

Moreover, the implications of such a price increase extend beyond immediate sales impacts. If Apple implements higher prices, it could establish a perception of the iPhone as a premium product that is increasingly out of reach for average consumers. This perception may deter potential buyers, resulting in a decline in overall sales volume. Therefore, Apple faces a daunting challenge in balancing the need to maintain profitability while ensuring that its flagship products remain accessible to its customer base.

Bank of America’s Analysis on Apple Manufacturing Costs

Bank of America’s recent analysis sheds light on the complexities of Apple’s manufacturing costs in relation to tariffs. Despite Apple’s efforts to diversify its manufacturing locations to mitigate tariff impacts, the bank estimates that Apple will still face a minimum of a 10% tariff on its products. This suggests that merely shifting production to countries with lower tariffs may not be a feasible long-term strategy. As such, Apple must navigate an intricate landscape of global manufacturing and pricing strategies to ensure its profitability.

The analysis also indicates that Apple’s historical exemptions from tariffs are becoming less reliable, forcing the company to reconsider its cost structures. The increasing costs associated with manufacturing and tariffs could compel Apple to reevaluate its pricing strategy. If Apple opts to absorb these costs rather than risk a price increase, it may face a significant reduction in earnings. This delicate balance between maintaining competitive pricing and managing manufacturing costs is crucial for Apple’s future growth and market positioning.

Strategies for Managing iPhone Sales Amid Tariff Increases

As tariffs continue to pose challenges for Apple, the company must devise effective strategies to manage iPhone sales. One potential approach is to implement gradual price increases rather than an abrupt jump that could alienate consumers. For instance, if Apple were to raise prices by a modest 3%, it could potentially limit the adverse impact on sales while still addressing some of the increased manufacturing costs. However, such a strategy requires careful consideration of market reactions and consumer behavior.

Additionally, Apple could explore enhancing the value proposition of its products through software updates, new features, or improved customer service. By emphasizing the unique aspects of the iPhone experience, Apple might justify the price increases and maintain consumer loyalty. Ultimately, how Apple navigates this challenging environment will significantly influence its market share and long-term success in the competitive smartphone industry.

Potential Consequences of iPhone Price Increases

In light of potential price increases due to tariffs, it’s essential to consider the broader consequences for Apple and its brand image. If consumers perceive the iPhone as becoming too expensive, it could lead to a decline in brand loyalty. The switch to Android devices may become more appealing for budget-conscious consumers, potentially resulting in a long-term loss of market share for Apple. This shift could be detrimental, as retaining customers is often more cost-effective than acquiring new ones.

Furthermore, the impact of price increases could extend beyond immediate sales figures. A sustained decline in iPhone sales could affect Apple’s overall revenue, leading to diminished investment in innovation and product development. This cyclical issue may create a challenging environment for Apple, particularly if competitors capitalize on any weaknesses that arise from reduced consumer interest. Thus, Apple must carefully navigate its pricing strategy to maintain its competitive edge while managing the financial implications of tariffs.

Long-Term Projections for iPhone Pricing Strategies

Looking ahead, analysts are closely monitoring how Apple will adjust its pricing strategies in response to evolving tariff landscapes. With Bank of America projecting a possible 9% increase in iPhone prices, Apple must weigh the potential benefits against the risk of losing market share. Long-term projections suggest that if Apple continues to raise prices without enhancing product value or consumer experience, it could face a significant backlash from its customer base, leading to decreased sales.

To counteract these potential pitfalls, Apple may need to invest in innovative marketing strategies that emphasize the quality and exclusivity of its products. By communicating the unique value proposition effectively, Apple could justify price increases while retaining a loyal customer base. Moreover, exploring alternative manufacturing strategies that reduce reliance on high-tariff countries could help mitigate some of the cost pressures, ensuring that iPhone prices remain competitive in the global market.

Monitoring Apple’s Response to Tariffs

As tariffs continue to influence the technology sector, it’s crucial to monitor Apple’s response to these challenges. The company’s historical lobbying efforts for tariff exemptions indicate a proactive approach, but the effectiveness of such measures remains uncertain. Analysts suggest that Apple’s ability to adapt to these changing conditions will be vital in determining its future success. If the company can navigate through the complexities of tariffs while maintaining consumer trust, it may mitigate some of the negative impacts on its pricing strategies.

Furthermore, ongoing communication from Apple regarding its strategies can bolster investor confidence. Transparency in how the company plans to handle the financial implications of tariffs will be essential in retaining stakeholder support. As the market evolves, investors and consumers alike will be keen to see how Apple positions itself amidst these challenges, particularly regarding the potential increase in iPhone prices.

The Role of Consumer Behavior in Pricing Decisions

Consumer behavior plays a crucial role in shaping Apple’s pricing decisions, particularly in light of potential tariff-induced price increases. Research indicates that consumers are highly sensitive to price changes, especially in competitive markets like smartphones. If Apple raises its prices by 9% in response to tariffs, it risks alienating budget-conscious consumers who may seek more affordable alternatives. Understanding consumer psychology and preferences will be vital for Apple as it navigates these potential pricing adjustments.

Moreover, Apple must consider how its loyal customer base perceives value. While some consumers may be willing to pay a premium for the iPhone’s features and ecosystem, others may draw the line at significant price hikes. By conducting market research and gathering consumer feedback, Apple can better gauge the elasticity of demand for its products and make informed pricing decisions that align with consumer expectations.

Future Implications for Apple’s Market Position

The implications of rising iPhone prices due to tariffs extend beyond immediate sales figures, potentially affecting Apple’s long-term market position. As competitors in the smartphone market continue to innovate and offer lower-priced alternatives, Apple must remain vigilant in maintaining its brand equity. If the company fails to respond effectively to the pressures of tariffs and pricing, it could face a decline in its competitive advantages, leading to a possible erosion of market share.

In addition, Apple’s ability to manage its supply chain in light of tariff challenges will play a significant role in its future success. By optimizing manufacturing processes and exploring cost-effective solutions, Apple can mitigate the impact of tariffs on pricing. The effectiveness of these strategies will ultimately determine how well Apple can maintain its market position and continue to attract consumers in an increasingly competitive landscape.

The Importance of Strategic Pricing in a Competitive Market

Strategic pricing is essential for Apple as it navigates the complexities of tariffs and their effects on iPhone prices. The company must carefully consider its pricing strategy to balance profitability with consumer demand. A well-planned pricing strategy that takes into account the potential impact of tariffs can help Apple maintain its competitive edge in the market while ensuring sustainable growth.

Furthermore, effective communication of pricing changes and the rationale behind them can foster consumer trust and loyalty. By being transparent about the reasons for price increases, such as rising manufacturing costs due to tariffs, Apple can mitigate potential backlash from its customer base. Ultimately, a strategic approach to pricing will be pivotal in helping Apple adapt to market challenges while continuing to thrive in the competitive smartphone industry.

Frequently Asked Questions

How will tariffs affect iPhone prices in the future?

According to Bank of America, tariffs could lead to a potential 9% increase in iPhone prices. This is because the burden of import tariffs will primarily fall on US companies like Apple, which may have to raise prices to maintain profit margins.

What impact do Apple manufacturing costs have on iPhone prices?

Apple’s manufacturing costs are a significant factor in determining iPhone prices. Recent analyses suggest that increased tariffs on imported components could raise these costs, potentially resulting in higher retail prices for iPhones.

Is there a possibility of a price increase for iPhones due to tariffs?

Yes, there is a possibility of an iPhone price increase due to tariffs. Bank of America estimates that Apple may need to raise prices by up to 9% to offset the impact of these tariffs on its earnings and manufacturing costs.

How do import tariffs affect iPhone sales?

Import tariffs can negatively impact iPhone sales by increasing retail prices. As prices rise due to tariffs, customers may consider switching to competing devices, which could result in a significant decrease in sales for Apple.

Will Apple absorb the costs of tariffs or increase iPhone prices?

Apple has the option to absorb the costs of tariffs, which could prevent immediate price increases on iPhones. However, if the costs become unsustainable, Apple might choose to raise prices, potentially by 9% as suggested by Bank of America.

What does Bank of America predict for iPhone prices amid tariff changes?

Bank of America predicts that iPhone prices may see a 9% increase in response to ongoing tariff changes. This adjustment is aimed at mitigating the financial impact that tariffs have on Apple’s earnings and overall sales.

How are iPhone prices influenced by Apple’s efforts to move manufacturing?

Apple’s attempts to move manufacturing to avoid tariffs have not alleviated the situation significantly. Current estimates indicate that regardless of manufacturing location, Apple will still face tariffs that could require price adjustments for iPhones.

What are the long-term implications of rising iPhone prices on Apple?

Long-term increases in iPhone prices could lead to reduced sales as customers may switch to more affordable alternatives. This shift could harm Apple’s market share and overall revenue, making it crucial for Apple to balance pricing strategies.

What strategies might Apple consider regarding iPhone pricing due to tariffs?

Apple may consider various strategies, including raising iPhone prices incrementally or absorbing costs in the short term. The approach will depend on how tariffs affect their earnings and customer demand.

How does the analysis from Bank of America reflect on the future of iPhone pricing?

The analysis from Bank of America suggests that unless Apple finds a way to mitigate tariff impacts, iPhone prices are likely to increase significantly. This underscores the importance of monitoring tariff developments and manufacturing strategies.

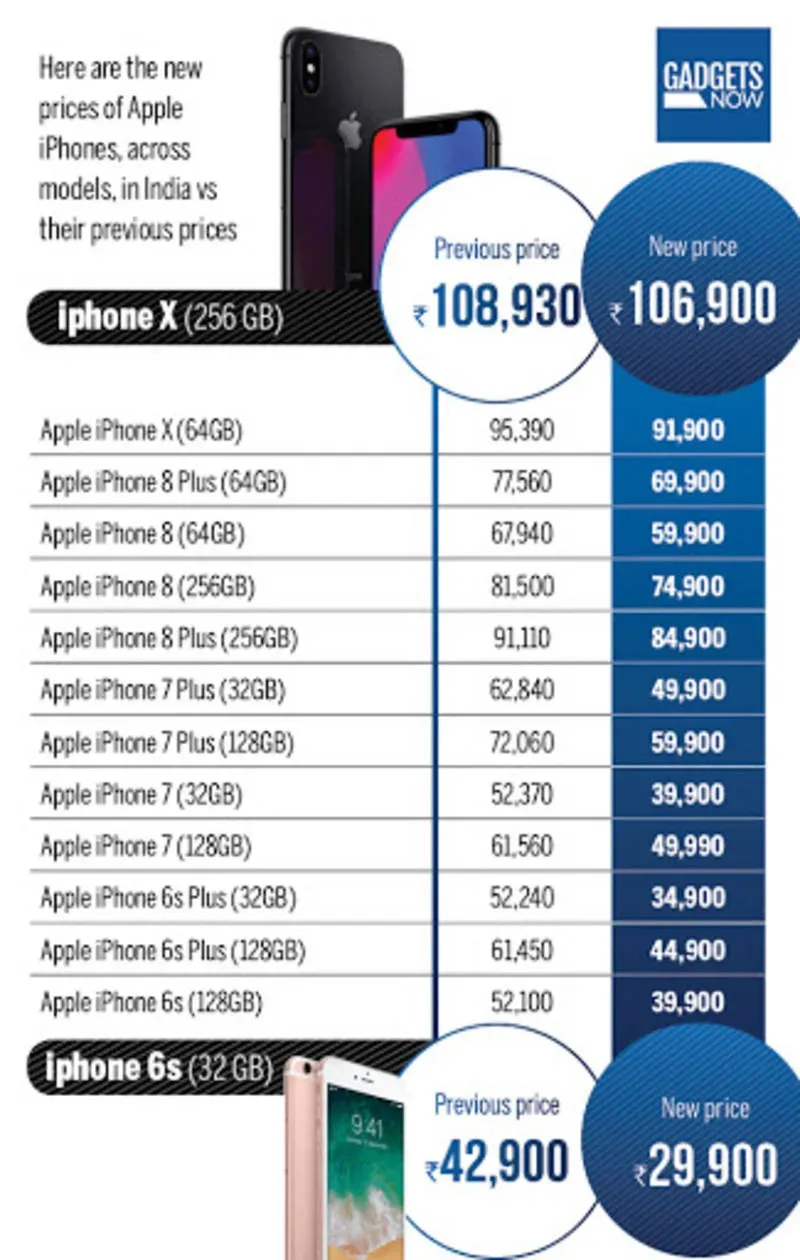

| Key Point | Details |

|---|---|

| Tariff Impact | Bank of America estimates a 9% price increase for iPhones due to import tariffs. |

| Cost Absorption | Apple may choose to absorb tariff costs instead of raising prices to avoid losing customers to competitors like Android. |

| Manufacturing Changes | Apple has attempted to reduce tariff impacts by relocating manufacturing, but this may not be effective against the 10% tariffs. |

| Potential Earnings Loss | If Apple absorbs the tariffs, it could result in a 26 cents loss in earnings per share, equating to a 3% drop in 2026. |

| Price Increase Option | A smaller price increase of 3% could still lead to a significant earnings drop, indicating that a 9% hike is necessary to maintain profit margins. |

| Future Actions | Apple is likely to continue lobbying for tariff exemptions while evaluating its pricing strategy. |

Summary

iPhone prices are expected to rise significantly due to the impact of tariffs imposed on imports. Bank of America has projected a 9% increase in iPhone prices to offset the costs associated with these tariffs. This potential price hike reflects the challenges Apple faces in maintaining profitability while navigating the complexities of manufacturing and distribution in a global market impacted by trade policies. As Apple considers its options, including the possibility of absorbing costs or passing them onto consumers, the future pricing of iPhones remains a critical factor for both the company and its customers.